尊敬的用户您好,这是来自FT中文网的温馨提示:如您对更多FT中文网的内容感兴趣,请在苹果应用商店或谷歌应用市场搜索“FT中文网”,下载FT中文网的官方应用。

One of the oldest and best-known hedge fund strategies has suffered nearly $150bn in client withdrawals over the past five years, as investors tire of their inability to capitalise on bull markets or protect them during downturns.

过去五年来,最古老、最著名的对冲基金策略之一已遭遇近1500亿美元的客户撤资,原因是投资者厌倦了它们无法在牛市中获利或在股市低迷时提供保护。

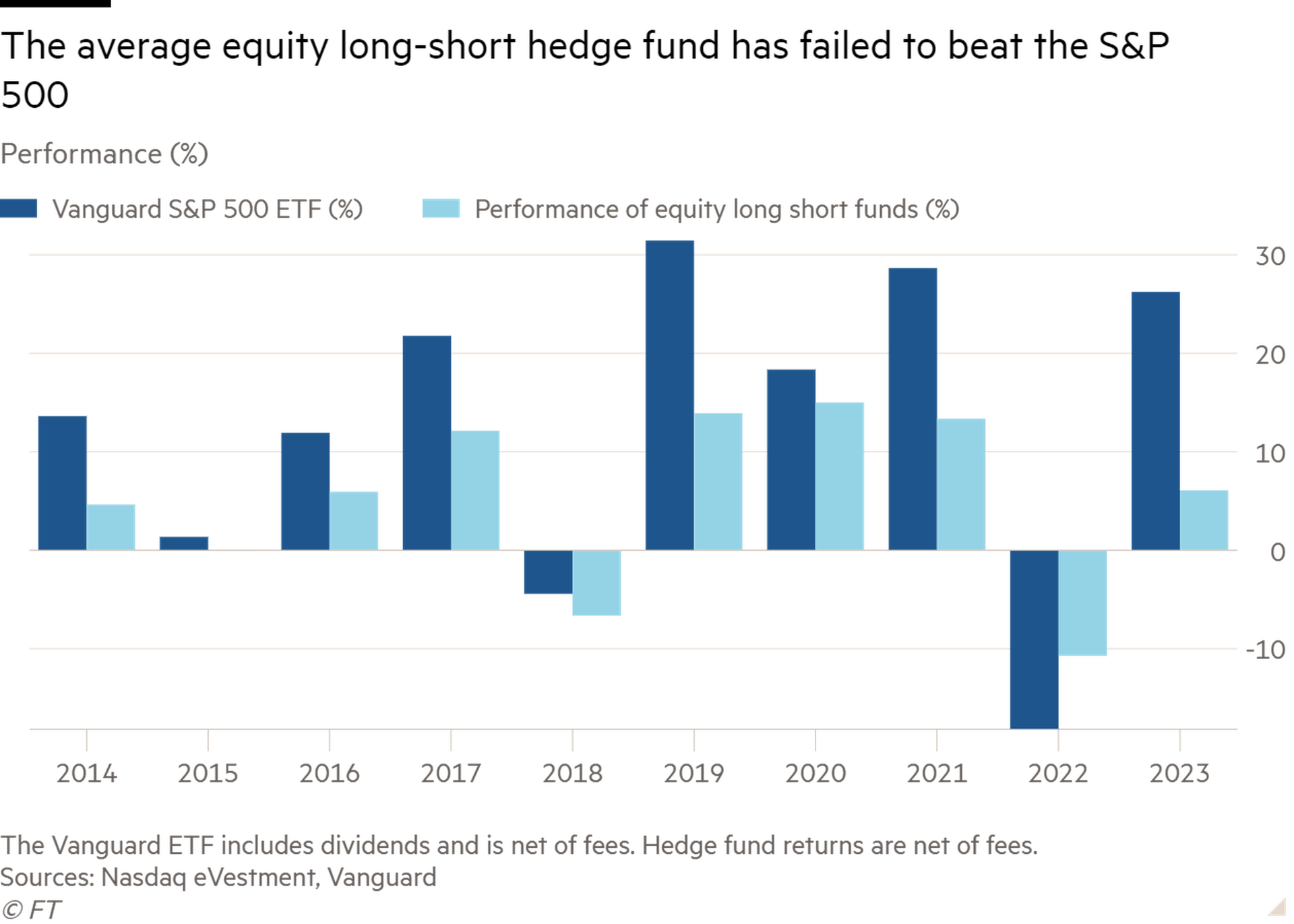

So-called equity long-short funds, which try to buy stocks likely to do well and bet against names set to perform poorly, have underperformed the US stock market in nine out of the past 10 years, according to Nasdaq eVestment, after failing to adapt to markets largely dominated by central banks.

根据纳斯达克电子投资公司(Nasdaq eVestment)的数据,所谓的股票多空基金(同时持有股票多头和股票空头仓位)在过去10年中有9年的表现不及美国股市,因为它们未能适应主要由央行主导的市场。

The poor performance and outflows mark a fall from grace for a strategy known for its star stockpickers such as Tiger Management’s Julian Robertson, GLG’s Pierre Lagrange and Egerton’s John Armitage.

业绩不佳和资金外流标志着以老虎管理公司(Tiger Management)的朱利安•罗伯逊(Julian Robertson)、GLG的皮埃尔•拉格朗日(Pierre Lagrange)和埃哲顿(Egerton)的约翰•阿米蒂奇(John Armitage)等明星选股人而闻名的投资策略失宠。

“Ten years ago people used to talk about the great equity stockpickers,” said Donald Pepper, the co-chief executive of hedge fund firm Trium, which manages around $1.7bn.

对冲基金公司Trium的联合首席执行官唐纳德•佩珀(Donald Pepper)表示:“十年前,人们经常谈论伟大的选股人。”Trium管理着约17亿美元。

“You still have some rock stars like [TCI’s] Chris Hohn, but there just aren’t many of him around anymore.”

“仍然有一些摇滚明星,比如(TCI的)克里斯•霍恩,但像他这样的人已经不多了。”

Pioneered in 1949 by investor Alfred Winslow Jones — seen as the world’s first hedge fund manager — equity long-short funds were designed to “hedge” against overall market fluctuations through their bets on both winning and losing stocks.

股票多空基金于1949年由投资者阿尔弗雷德•温斯洛•琼斯(Alfred Winslow Jones)开创,他被视为世界上第一位对冲基金经理,旨在通过同时押注上涨和下跌的股票来“对冲”整体市场波动。

The strategy made double-digit returns in almost every year of the 1990s bull market, according to data group HFR, with many funds then profiting by shorting wildly overvalued dotcom groups in the ensuing bust. During the global financial crisis, funds such as Lansdowne Partners made millions betting against doomed UK lender Northern Rock.

根据数据集团HFR的数据,在20世纪90年代的牛市中,该策略几乎每年都能获得两位数的回报,许多基金在随后的泡沫破裂中通过做空估值过高的互联网集团而获利。在全球金融危机期间,Lansdowne Partners等基金通过押注注定倒闭的英国北岩银行(Northern Rock)获利数百万美元。

But since then many funds have struggled, coming unstuck in markets dominated by central bank bond-buying and low interest rates. In the meantime, they have badly lagged cheap index tracker funds that have reaped huge gains from the bull market.

但自那以后,许多基金一直在挣扎,在以央行债券购买和低利率为主的市场中陷入困境。与此同时,它们严重落后于从牛市中获得巨大收益的廉价指数跟踪基金。

An investor who put $100 into an equity long-short hedge fund 10 years ago would now on average have $163, according a Financial Times analysis of figures provided by Nasdaq eVestment. Had they invested in Vanguard’s S&P 500 tracker with dividends reinvested they would have $310.

根据英国《金融时报》对纳斯达克电子投资公司提供的数据的分析,10年前向股票多空对冲基金投资100美元的投资者现在平均拥有163美元。如果他们投资于Vanguard的标普500指数跟踪基金,并将股息再投资,他们将拥有310美元。

“You don’t need your hedge funds to beat the S&P every year, but you do want them to beat it over time, for instance over the past decade,” said a pension fund adviser who allocates billions of dollars to hedge funds.

一位向对冲基金配置数十亿美元资金的养老基金顾问表示:“你不需要你的对冲基金每年都击败标准普尔,但你确实希望它们能在一段时期击败它,比如在过去十年。”

Big-name funds have suffered. Some of the so-called Tiger cubs — managers who trace their roots back to Robertson’s firm — were among those hard hit in 2022’s market sell-off, including Chase Coleman’s once- high-flying Tiger Global and Lee Ainslie’s Maverick Capital.

大牌基金也遭受了损失。一些所谓的“虎崽”——经理来自罗伯逊的公司——在2022年的市场抛售中受到重创,包括Chase Coleman曾经高歌猛进的老虎环球(Tiger Global)和Lee Ainslie的Maverick Capital。

In October the FT highlighted billions of dollars of outflows from London-based hedge fund Pelham Capital, run by former Lansdowne portfolio manager Ross Turner, and it 2022 the FT revealed Roderick Jack and Marcel Jongen’s Adelphi Capital would return capital and become a family office.

10月,英国《金融时报》报道了总部位于伦敦的对冲基金Pelham Capital的数十亿美元资金外流,该基金由前Lansdowne投资组合经理Ross Turner管理。2022年,英国《金融时报》透露Roderick Jack和Marcel Jongen的Adelphi Capital将退还资本,并变为家族办公室。

When Lansdowne shut its flagship Developed Markets equity fund in 2020, after admitting it had become hard to find stocks to short, many saw it as a sign of a deep malaise in the sector.

Lansdowne在承认已经很难找到可以做空的股票后,于2020年关闭了其旗舰发达市场股票基金,许多人认为这是该行业陷入严重困境的迹象。

Long-short managers complained for years that ultra-low interest rates allowed weaker companies — which would previously have been excellent targets to short — to stumble on for longer and, in some cases, for their share prices to soar. That, they said, made it harder for them to profit.

多年来,多空基金经理们一直抱怨,超低利率让实力较弱的公司(这些公司以前本是极佳的做空目标)能够残喘更长的时间,在某些情况下股价还会飙升。他们说,这使他们更难获利。

But a sharp rise in interest rates over the past two years has failed to revive the strategy’s fortunes. After large losses in 2022’s downturn, funds were meant to have their breakout year last year as higher rates sifted stronger companies from weaker firms. But funds gained 6.1 per cent on average, compared with the S&P 500’s 26.3 per cent gain.

但过去两年利率的急剧上升未能重振该策略的命运。在经历了2022年的巨大损失后,随着利率上升让更强的公司从更弱的公司中脱颖而出,基金本应在去年迎来爆发之年。但基金平均上涨6.1%,而标普500指数上涨26.3%。

Adam Singleton, chief investment officer of external alpha at Man Solutions, which invests in other hedge funds, said low volatility and last year’s bull market made it hard for long-short managers to prove themselves.

投资于其他对冲基金的Man Solutions外部阿尔法首席投资官Adam Singleton表示,低波动性和去年的牛市使得多空基金经理很难证明自己。

“Higher interest rates should lead to more good companies succeeding and bad companies failing, but I think markets were very focused on what policymakers like the [US Federal Reserve] would do.”

“更高的利率应该导致更多的好公司成功,坏公司失败,但我认为市场非常关注像(美联储)这样的政策制定者会做什么。”

After more than a decade of excuses, investors are losing patience. Richard Byworth, managing partner at Syz Capital, said his portfolios have not invested in equity long-short funds for close to two years.

经过十多年的辩解,投资者正在失去耐心。Syz Capital的管理合伙人Richard Byworth表示,他的投资组合已经有近两年没有投资股票多空基金了。

“With high fees, long-short managers are just not delivering performance anywhere near a level that would justify a position in our portfolio,” he said. “It is that simple.”

他说:“在高收费的情况下,多空基金经理的表现根本无法达到在我们的投资组合中占有一席之地的水平。就是这么简单。”

After 23 consecutive months of investor withdrawals, assets in equity long-short funds are down to $723bn, below levels five years ago, according to Nasdaq eVestment. Some of this has flowed to multi-manager hedge funds, which spread clients’ money over a range of strategies including long-short equity. Such funds invest heavily in risk management and are far less affected by the performance of a star stockpicker.

根据纳斯达克电子投资公司的数据,在投资者连续23个月撤资后,股票多空基金的资产已降至7230亿美元,低于五年前的水平。其中部分资金流向了多管理人对冲基金,这些基金将客户的资金分散到包括股票多空策略在内的一系列策略中。这类基金在风险管理方面投入巨大,受明星选股人表现的影响要小得多。

Not everyone is downbeat. There are early signs that shorting is finally becoming “more fruitful” as higher rates hit poor-quality companies, said one executive, while some allocators such as Kier Boley, co-head of alternative investment solutions at Swiss allocator UBP, think funds will profit as the market’s attention switches back to company fundamentals.

并非所有人都不乐观。一位高管表示,随着利率上升打击劣质公司,有早期迹象表明做空终于变得“更有成效”,而一些配置者,如瑞士UBP的另类投资解决方案联席主管Kier Boley认为,随着市场的注意力重新转向公司基本面,基金将从中获利。

“I am bullish on the prospects for long-short strategies,” said Mario Unali, a portfolio manager at investment firm Kairos. “We will see long-short funds likely roar back to pre-2008 levels.”

投资公司Kairos的投资组合经理Mario Unali表示:“我看好多空策略的前景。我们将看到多空基金可能会飙升至2008年之前的水平。”

But an executive at one top long-short fund was less optimistic, saying a widely anticipated fall in global interest rates would hurt the sector.

但一家顶级多空基金的高管则不那么乐观,称普遍预期的全球利率下降将损害该行业。

“Which hedge fund has ever said that the next decade won’t be great [for their particular strategy]?” he said. “[But] long-short hedge funds will continue to dwindle if rates go back down to zero.”

他说:“哪家对冲基金说过未来十年(对他们的特定战略)不会很好?(但)如果利率回落至零,多空对冲基金将继续减少。”

Additional reporting by Laurence Fletcher

Laurence Fletcher补充报道