尊敬的用户您好,这是来自FT中文网的温馨提示:如您对更多FT中文网的内容感兴趣,请在苹果应用商店或谷歌应用市场搜索“FT中文网”,下载FT中文网的官方应用。

Few people have had the sort of front-row seat to the rise of electric vehicles as JB Straubel.

很少有人能像J·B·斯特劳贝尔(JB Straubel)那样,亲眼目睹电动汽车的崛起。

The soft-spoken engineer is often considered the brains behind Tesla: it was Straubel who convinced Elon Musk, over lunch in 2003, that electric vehicles had a future. He then served as chief technology officer for 15 years, designing Tesla’s first batteries, managing construction of its network of charging stations and leading development of the Gigafactory in Nevada. When he departed in 2019, Musk’s biographer Ashlee Vance said Tesla had not only lost a founder, but “a piece of its soul”.

这位说话温和的工程师通常被认为是特斯拉背后的智囊:正是斯特劳贝尔在2003年的午餐会上说服了埃隆·马斯克(Elon Musk),电动汽车是有未来的。随后,他担任了15年的首席技术官,设计了特斯拉的第一批电池,管理充电站网络的建设,并领导了内华达州Gigafactory的开发。2019年马斯克离开时,马斯克的传记作者阿什利·万斯(Ashlee Vance)表示,特斯拉不仅失去了一位创始人,还失去了“一部分灵魂”。

Straubel could have gone on to do anything in Silicon Valley. Instead, he stayed at his ranch in Carson City, Nevada, a town once described by former resident Mark Twain as “a desert, walled in by barren, snow-clad mountains” without a tree in sight.

斯特劳贝尔本可以在硅谷做任何事情。相反,他住在内华达州卡森市(Carson City)的农场里,这里的前居民马克·吐温(Mark Twain)曾形容这个小镇是“一片沙漠,被贫瘠、白雪覆盖的山脉包围着”,看不到一棵树。

At first glance it is not the most obvious location for Redwood Materials, a start-up Straubel founded in 2017 with a formidable mission bordering on alchemy: to break down discarded batteries and reconstitute them into a fresh supply of metals needed for new electric vehicles.

乍一看,这里并不是Redwood Materials最显眼的位置。Redwood Materials是斯特劳贝尔于2017年创建的一家初创企业,它的艰巨使命近乎炼金术:将废弃电池分解,重新组装成新电动汽车所需的新金属。

His goal is to solve the most glaring problem for electric vehicles. While they are “zero emission” when being driven, the mining, manufacturing and disposal process for batteries could become an environmental disaster for the industry as the technology goes mainstream.

他的目标是解决电动汽车最突出的问题。虽然它们在驾驶时是“零排放”的,但随着技术的主流化,电池的开采、制造和处理过程可能会成为该行业的环境灾难。

“It’s not sustainable at all today, nor is there really an imminent plan — any disruption happening — to make it sustainable,” Straubel says. “That always grated on me a little bit at Tesla and it became more apparent as we ramped everything up.”

斯特劳贝尔说:“这在今天是不可持续的,也没有一个迫在眉睫的计划——任何破坏正在发生——来使它可持续。在特斯拉时,这一点总是让我感到不快,随着我们把所有东西都提升了,这一点变得更加明显。”

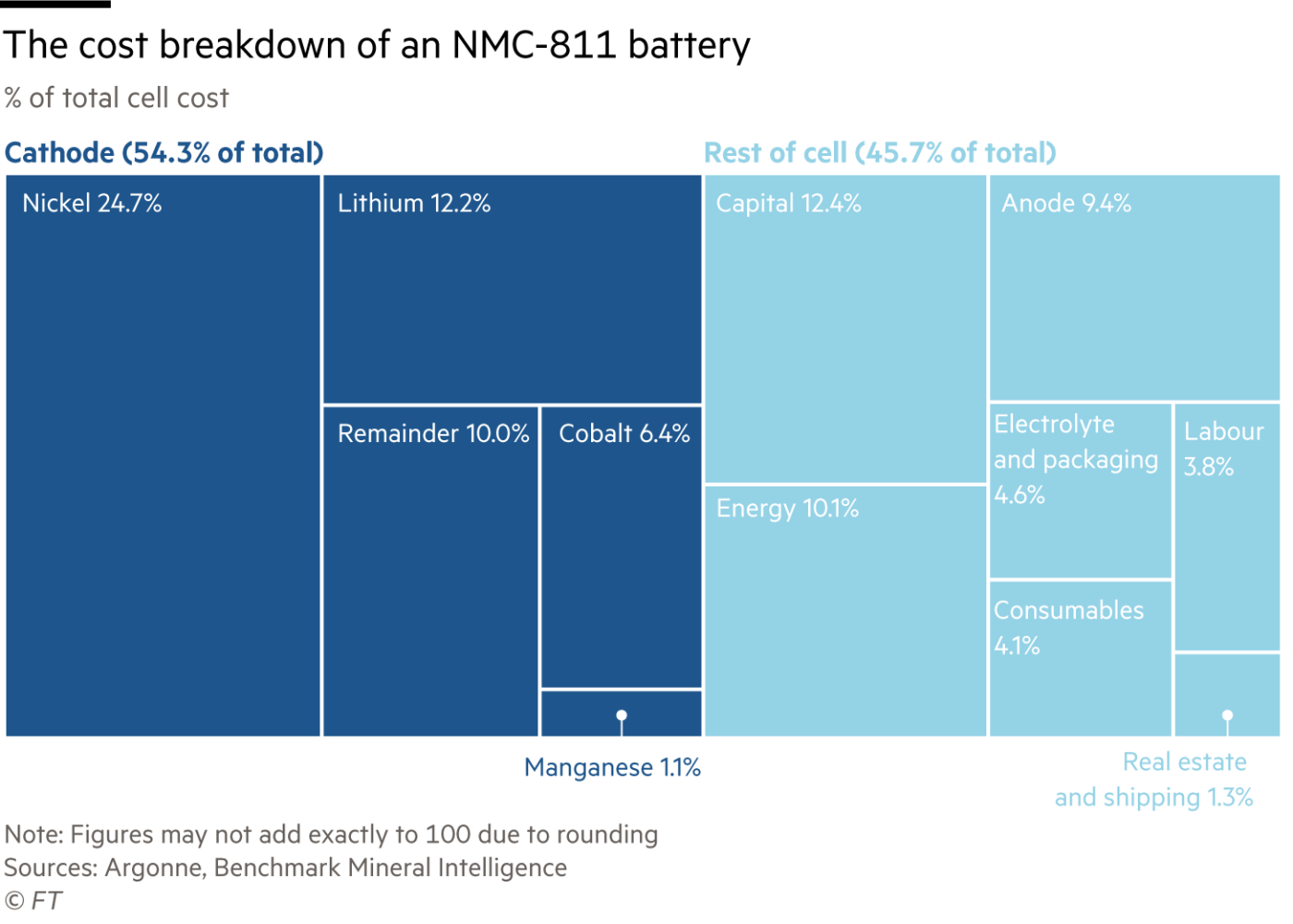

Redwood’s warehouse is the ultimate example of how one person’s trash is another person’s treasure. Each weekday, two to three heavy duty lorries drop off about 60 tonnes worth of old smartphones, power tools and scooter batteries. Straubel’s team of 130 employees then separates out the metals — including nickel, cobalt and lithium — pulverises them and treats them with chemicals so they can re-enter the supply chain as the building blocks for new lithium-ion batteries.

Redwood的仓库是一个绝佳的例子,说明一个人的垃圾是另一个人的宝藏。每个工作日,两到三辆重型卡车会运送大约60吨的旧智能手机、电动工具和踏板车电池。然后,斯特劳贝尔的130名员工团队将金属(包括镍、钴和锂)分离出来,粉碎后用化学物质处理,这样它们就可以重新进入供应链,作为新型锂离子电池的基石。

The metals used in batteries typically originate in the Democratic Republic of Congo, Australia and Chile, dug out of open pit mines or evaporated from desert ponds. But Straubel believes there is another “massive, untapped” source: the garages of the average American. He estimates there are about 1bn used batteries in US homes, sitting in old laptops or mobile phones — all containing valuable metals.

电池中使用的金属通常产自刚果民主共和国、澳大利亚和智利,有的从露天矿场开采,有的从沙漠池塘中蒸发。但斯特劳贝尔相信还有另一个“巨大的、尚未开发的”来源:普通美国人的汽车修理厂。他估计,在美国家庭中,大约有10亿块废旧电池,放在旧笔记本电脑或手机里,这些电池都含有贵重金属。

The process of breaking down these batteries and repurposing them is known as “urban mining”. To do this at scale is a gargantuan task: the amount of battery material in a high-end electric vehicle is roughly 10,000 times that of a smartphone, according to Gene Berdichevsky, chief executive of battery materials start-up Sila Nano. But, he adds, the amount of cobalt used in a car battery is about 30 times less than in a phone battery, per kilowatt hour. “So for every 300 smartphones you collect, you have enough cobalt for an EV battery.”

分解这些电池并将其重新利用的过程被称为“城市采矿”。要大规模做到这一点是一项艰巨的任务:电池材料初创企业Sila Nano的首席执行官吉恩•贝尔迪切夫斯基(Gene Berdichevsky)表示,一辆高端电动汽车所用的电池材料大约是一部智能手机的1万倍。但是,他补充道,汽车电池每千瓦时使用的钴含量大约是手机电池的30倍。“所以,你每收集300部智能手机,就有足够的钴来生产电动汽车电池。”

Redwood is also building a network of industrial partners, including Amazon, electric bus maker Proterra and e-bike maker Specialized, to receive their scrap. It already receives e-waste from, and sends back repurposed materials to, Panasonic, which produces battery cells just 50 miles north at the Tesla Gigafactory.

Redwood还在建立一个工业合作伙伴网络,以接收他们的废料,其中包括亚马逊、电动巴士制造商Proterra和电动自行车制造商Specialized。它已经从松下(Panasonic)接收电子垃圾,并将重新利用的材料送回松下。松下在特斯拉超级工厂(Tesla Gigafactory)以北50英里处生产电池。

Straubel is betting part of his Tesla fortune that Redwood can play an instrumental role in the emergence of “the circular economy” — a grand hope born in the 1960s that society can re-engineer the way goods are designed, manufactured and recycled. The concept is being embraced by some of the world’s largest companies including Apple, whose chief executive Tim Cook set an objective “not to have to remove anything from the earth to make the new iPhones” as part of its pledge to be carbon-neutral by 2030.

斯特劳贝尔将他在特斯拉的部分财富押注于Redwood可以在“循环经济”的出现中发挥重要作用。“循环经济”是20世纪60年代诞生的一个伟大希望,社会可以重新设计商品的设计、制造和回收方式。这一概念受到了包括苹果(Apple)在内的一些全球最大公司的欢迎。苹果首席执行官蒂姆•库克(Tim Cook)设定了一个目标,“不必从地球上拿走任何东西来制造新iphone”,作为其到2030年实现碳中和的承诺的一部分。

Cobalt’s 20,000-mile journey

钴的20000英里旅程

If the circular economy takes root, today’s status quo will look preposterous to future generations. The biggest source of cobalt at the moment is the DRC, where it is often extracted in both large industrial mines and also dug by hand using basic tools. Then it might be shipped to Finland, home to Europe’s largest cobalt refinery, before heading to China where the majority of the world’s cathode and battery production takes place. From there it can be shipped to the US or Europe, where battery cells are turned into packs, then shipped again to automotive production lines.

如果循环经济扎根,今天的现状在后代看来将是荒谬的。目前钴的最大来源是刚果民主共和国,在那里,钴通常是在大型工业矿山中提取的,也经常是用基本工具手工挖掘的。然后,它可能会被运往欧洲最大的钴冶炼厂所在地芬兰,然后再运往世界上大部分阴极和电池生产的中国。在那里,它可以被运往美国或欧洲,在那里,电池被制成电池组,然后再被运往汽车生产线。

All told, the cobalt can travel more than 20,000 miles from the mine to the automaker before a buyer places a “zero emission” sticker on the bumper.

总而言之,在买家把“零排放”标签贴在保险杠上之前,这种钴可以从矿场运到汽车制造商那里,行程超过2万英里。

Despite this, independent studies routinely say electric vehicles cause less environmental damage than their combustion engine counterparts. But the scope for improvement is vast: Straubel says electric car emissions can be more than halved if their batteries are continually recycled.

尽管如此,一些独立研究仍然认为,电动汽车对环境的破坏要小于内燃机汽车。但改进的空间是巨大的:斯特劳贝尔说,如果电动汽车的电池不断循环使用,其排放量可以减少一半以上。

In July, Redwood accelerated its mission, raising more than $700m from investors so it could hire more than 500 people and expand operations. At a valuation of $3.7bn, the company is now the most valuable battery recycling group in North America. This year it expects to process 20,000 tonnes of scrap and it has already recovered enough material to build 45,000 electric vehicle battery packs.

今年7月,Redwood加快了使命,从投资者那里筹集了7亿多美元,这样它就可以雇佣500多名员工并扩大业务。该公司目前的估值为37亿美元,是北美最有价值的电池回收集团。今年,该公司预计将处理2万吨废料,并且已经回收了足够制造4.5万个电动汽车电池组的材料。

Advocates say a circular economy could create a more sustainable planet and reduce mountains of waste. In 2019 the World Economic Forum estimated that “a circular battery value chain” could account for 30 per cent of the emissions cuts needed to meet the targets set in the Paris accord and “create 10m safe and sustainable jobs around the world” by 2030.

支持者表示,循环经济可以创造一个更可持续的地球,减少堆积如山的废物。2019年,世界经济论坛(World Economic Forum)估计,要实现《巴黎协定》(Paris accord)设定的目标,并到2030年“在全球创造1000万个安全和可持续的就业岗位”,“一个循环电池价值链”可能占到所需减排的30%。

Kristina Church, head of sustainable solutions at Lombard Odier Investment Managers, says transportation is “central” to creating a circular economy, not only because it accounts for a sixth of global CO2 emissions but because it intersects with mining and the energy grid.

Lombard Odier投资管理公司可持续解决方案负责人克里斯蒂娜•丘奇(Kristina Church)表示,交通运输是创建循环经济的“核心”,不仅因为它占全球二氧化碳排放量的六分之一,还因为它与采矿和能源网络存在交集。

“For the world to hit net zero — by 2050 you can’t do it with just resource efficiency, switching to EVs and clean energy, there’s still a gap,” Kunal Sinha, head of copper and electronics recycling at miner Glencore says. “That gap can be closed by driving the circular economy, changing how we consume things, how we reuse things, and how we recycle.

矿业公司嘉能可(Glencore)铜和电子产品回收部门主管库纳尔•辛哈(Kunal Sinha)表示:“要想让全球实现净零排放——到2050年,光靠提高资源效率、改用电动汽车和清洁能源是不可能的,目前仍有差距。通过推动循环经济,改变我们消费、再利用和循环利用的方式,可以缩小这一差距。

“Recycling plays a role,” he adds. “Not only do you provide extra supply to close the demand gap, but you also close the emissions gap.”

“回收利用也发挥了作用,”他补充道。“你不仅可以提供额外的供应来缩小需求差距,还可以缩小排放差距。”

Unintended consequences

意想不到的后果

Although niche today, urban mining is set to become mainstream this decade given the broad political support for electric vehicles and policies to address climate change. Jennifer Granholm, US secretary of energy, has called for “a national commitment” to building a domestic supply chain for lithium-based batteries.

尽管现在只是小众市场,但鉴于电动汽车和应对气候变化的政策得到了广泛的政治支持,城市采矿在未来十年将成为主流。美国能源部长詹妮弗•格兰霍姆呼吁“国家承诺”建立国内锂电池供应链。

It is part of the Biden administration’s goal to reach 100 per cent clean electricity by 2035 and net zero emissions by 2050. Granholm has also said the global market for clean energy technologies will be worth $23tn by the end of this decade and warned that the US risks “bring[ing] a knife to a gunfight” as rival countries, particularly China, step up their investments.

这是拜登政府到2035年实现100%清洁电力、到2050年实现净零排放目标的一部分。格兰霍姆还表示,到本世纪末,全球清洁能源技术市场的价值将达到23万亿美元。格兰霍姆警告称,随着竞争对手(尤其是中国)加大投资,美国可能是“拿着刀参加枪战”(bring a knife to a gunfight)。

In Europe, regulators emphasise environmental and societal concerns — such as the looming threat of job losses in Germany if carmakers stop producing combustion engines. Meanwhile, Beijing is subsidising the sector to boost sales of electric vehicles by 24 per cent every year for the rest of the decade, according to McKinsey.

在欧洲,监管机构强调环境和社会方面的担忧——比如,如果汽车制造商停止生产内燃机,德国可能面临失业的威胁。与此同时,根据麦肯锡(McKinsey)的数据,中国政府正在补贴电动汽车行业,以便在本10年余下的时间里,每年将电动汽车销量提高24%。

This support, however, could have unintended consequences.

然而,这种支持可能会产生意想不到的后果。

A shortage of semiconductors this year demonstrated the vulnerability of the “just-in-time” automotive supply chain, with global losses estimated at more than $110bn. The chip shortage is perhaps a harbinger of a much larger disruption caused by coming bottlenecks for nickel, cobalt and lithium as every carmaker looks to electrify their vehicle portfolio.

今年半导体供应短缺,显示出“准时制”汽车供应链的脆弱性,全球亏损估计超过1100亿美元。芯片短缺或许预示着,镍、钴和锂的瓶颈即将到来,将引发一场规模大得多的混乱,每家汽车制造商都在寻求将自己的汽车组合实现电气化。

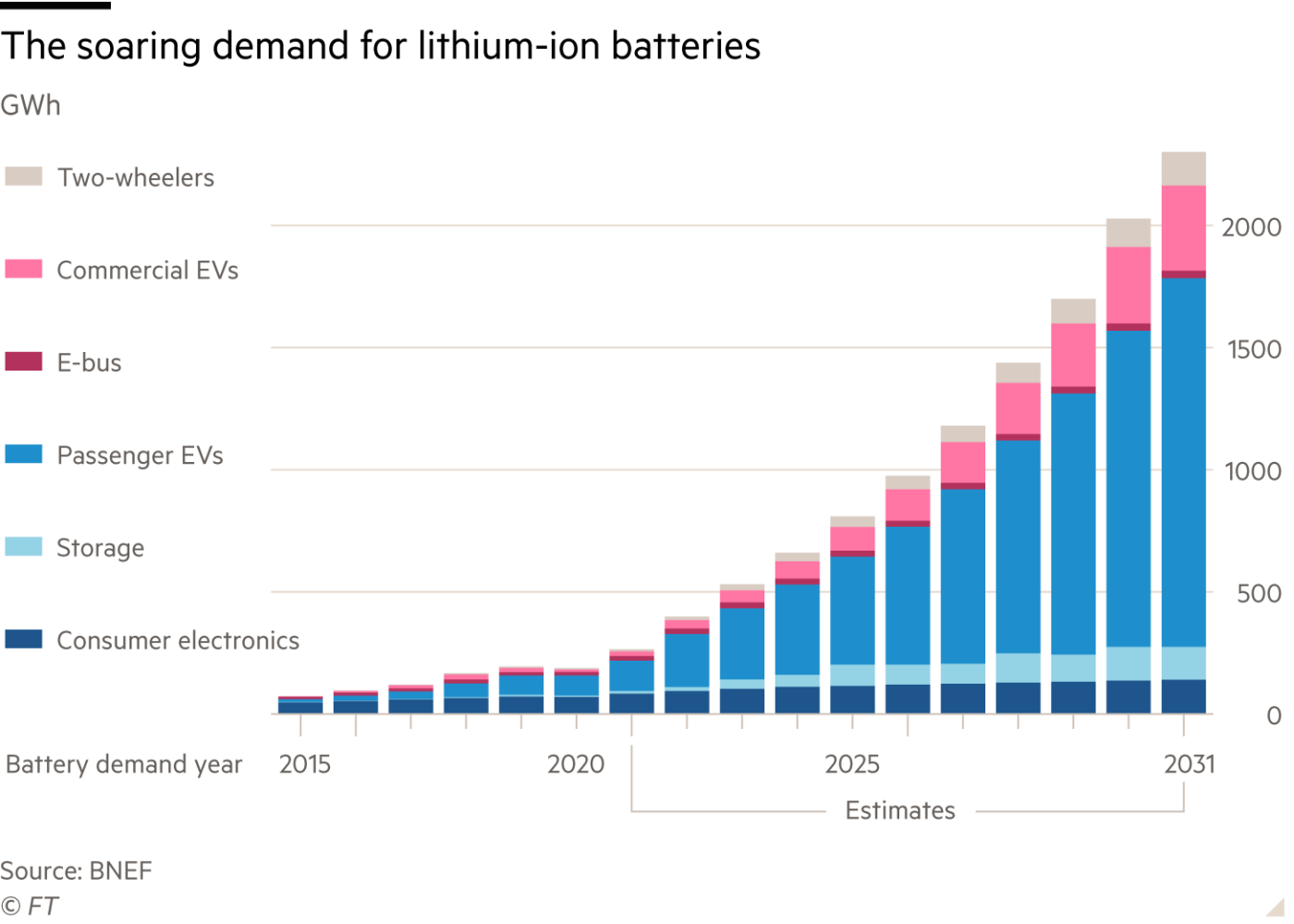

Electric car sales last year accounted for just 4 per cent of the global total. That is projected to expand to between 24 and 34 per cent in 2030 and then swell to between 30 and 70 per cent a decade later, according to BloombergNEF.

去年,电动汽车销量仅占全球总销量的4%。据彭博NEF预测,到2030年,这一比例将增至24%至34%,10年后将增至30%至70%。

“There is going to be a mass scramble for these materials,” says Paul Anderson, a professor at the University of Birmingham. “Everyone is panicking about how to get their technology on to the market and there is not enough thought to recycling.”

伯明翰大学(University of Birmingham)教授保罗•安德森(Paul Anderson)表示:“对这些材料的争夺将会非常激烈。每个人都对如何将自己的技术推向市场感到恐慌,对回收也没有足够的考虑。”

Monica Varman, a clean tech investor at G2 Venture Partners, estimates that demand for battery metals will exceed supply in two to three years, leading to a “crunch” lasting half a decade as the market reacts by redesigning batteries with sustainable materials. Recycled materials could help ease supply concerns, but analysts believe it will only be enough to cover 20 per cent of demand at most over the next decade.

G2 Venture Partners的清洁技术投资者莫妮卡•瓦尔曼(Monica Varman)估计,电池金属的需求将在两到三年内超过供应,随着市场的反应是用可持续材料重新设计电池,将导致持续五年的“危机”。回收材料可能有助于缓解供应担忧,但分析师们认为,未来10年,回收材料最多只能满足20%的需求。

So far, only a handful of start-ups besides Redwood have emerged to tackle the challenge of reconstituting discarded materials. One is Li-Cycle, based in Toronto and founded in 2016, which earlier this year raised more than $600m in a merger with a special purpose acquisition company valuing it at $1.7bn. Li-Cycle has already lined up partnerships with 14 automotive and battery companies, including Ultium, a joint venture between General Motors and LG Chem.

到目前为止,除了Redwood公司,只有少数几家初创公司已经出现,以应对重新组合废弃材料的挑战。其中一家是成立于2016年、总部位于多伦多的Li-Cycle。今年早些时候,该公司与一家特殊目的收购公司合并,融资逾6亿美元,使其估值达到17亿美元。Li-Cycle已经与14家汽车和电池企业建立了合作伙伴关系,其中包括通用汽车(General Motors)和LG化学(LG Chem)的合资企业Ultium。

Tim Johnston, Li-Cycle chair, says the group’s plan is to create facilities it calls “spokes” around North America, where it will collect used batteries and transform them into “black mass” — the powder form of lithium, nickel, cobalt and graphite. Then it will build larger “hubs”, where it can reprocess more than 95 per cent of the substance into battery-grade material.

Li-Cycle主席蒂姆·约翰斯顿(Tim Johnston)说,该组织的计划是在北美各地建立名为“辐条”的设施,在那里收集用过的电池,并将它们转化为“黑色物质”——锂、镍、钴和石墨的粉末形式。然后,它将建造更大的“枢纽”,在那里,它可以将超过95%的这种物质再加工成电池级材料。

Without urban mining at scale, Johnston worries that the coming shortages will be like the 1973 Arab oil embargo, when US petrol prices quadrupled within four months, imposing what the US state department described as “structural challenges to the stability of whole national economies”.

约翰斯顿担心,如果没有大规模的城市采矿,即将到来的短缺将像1973年阿拉伯石油禁运时那样,当时美国汽油价格在4个月内上涨了4倍,给“整个国家经济的稳定带来了美国国务院所说的结构性挑战”。

“Oil you can actually turn back on relatively quickly — it doesn’t take that long to develop a well and to start pumping oil,” says Johnston. “But if you look at the timeline that it takes to develop a lithium asset, or a cobalt asset, or a nickel asset, it’s a minimum of five years.

“实际上,石油可以相对较快地恢复生产,开发一口井并开始抽油并不需要那么长时间。”约翰斯顿说,“但如果你看看开发锂、钴或镍资产所需的时间,至少需要5年。”

“So not only do you have the potential to have the same sort of implications of the oil embargo,” he adds, “but [the effects] could be prolonged.”

他说:“因此,不仅有可能产生与石油禁运相同的影响,而且(影响)可能是长期的。”

Design complications

设计复杂化

Beyond aiding supply constraints and helping the environment, urban mining could also prove cheaper. A 2018 study on the recycling of gold and copper from discarded TV sets in China found the process was 13 times more economical than virgin mining.

除了缓解供应限制和保护环境外,城市采矿也可能更便宜。2018年一项关于从中国废弃电视机中回收金和铜的研究发现,这一过程的经济效益是原始采矿的13倍。

Straubel points out that the concentration of valuable material is considerably higher in existing batteries versus mined materials.

斯特劳贝尔指出,与开采的材料相比,现有电池中有价值材料的浓度要高得多。

“With rock and ores or brines, you have very low concentrations of these critical materials,” he says. “We’re starting with something that already is quite high concentration and also has all the interesting materials together in the right place. So it’s really a huge leg up over the problem mining has.”

“在岩石、矿石或卤水中,这些关键物质的浓度非常低,”他说。“我们从浓度已经相当高的物质开始,而且所有有趣的材料都在正确的位置。因此,这确实是一个巨大的优势,在矿业的问题。”

The top-graded lithium found in mines today are just 2 to 2.5 per cent lithium oxide, whereas in urban mining the concentration is four to five times that, adds Li-Cycle’s Johnston.

Li-Cycle公司的约翰斯顿补充说,目前在矿山中发现的顶级锂只含有2%至2.5%的锂氧化物,而在城市采矿中,锂氧化物的浓度是这个水平的4至5倍。

Still, the process of extracting valuable materials from discarded products is complicated by designs that fail to consider their end of life. “Today, the design parameters are for quick assembly, for cost, for quality, fit and finish,” says Ed Boyd, head of the experience design group at Dell, the computer company. Some products take 20 or 30 minutes to disassemble — so laborious that it becomes impractical.

尽管如此,从废弃产品中提取有价值材料的过程还是很复杂的,因为这些设计没有考虑到它们的寿命结束。电脑公司戴尔(Dell)体验设计小组负责人埃德•博伊德(Ed Boyd)表示:“如今,设计参数是为了快速组装、成本、质量、装配和精加工。”有些产品需要20或30分钟才能拆卸——如此费力以至于变得不实用。

His team is now investigating ways to “drastically” cut back the number of materials used and make it so products can come apart in under a minute. “That’s actually not that hard to do,” he says. “We just haven’t had disassembly as a design parameter before.”

他的团队现在正在研究如何“大幅”减少所用材料的数量,使产品可以在一分钟内分解。他说:“这其实不难做到。我们只是以前没有把拆卸作为设计参数。”

‘Monumental task’

“艰巨的任务”

While few dismiss the circular economy out of hand, there are plenty of sceptics who doubt these processes can be scaled up quickly enough to meet near-exponential demand for clean energy technologies in the next decade. “Recycling sounds very sexy,” says Julian Treger, chief executive of mining company Anglo Pacific. “But, ultimately, [it] is like smelting and refining. It’s a value added processing piece which doesn’t generally have enormous margins.”

尽管很少有人认为循环经济已经失控,但仍有很多人怀疑,这些过程能否迅速扩大,以满足未来10年对清洁能源技术近乎指数级的需求。“回收听起来非常诱人。”矿业公司英美资源太平洋(Anglo Pacific)首席执行官朱利安•特雷格(Julian Treger)表示,“但归根结底,(它)就像熔炼和精炼。这是一种增值加工产品,通常利润率不高。”

Brian Menell, the founder of TechMet, a company that invests in mining, processing and recycling of technology metals and is partly owned by the US government, calls it “a monumental task”. “In 10 years’ time a fully optimised developed lithium-ion recycling battery industry will maybe provide 25 per cent of the battery metal requirements for the electric vehicle industry,” he says. “So it will be a contributor, but it’s not a solution.”

TechMet是一家投资于科技金属的开采、加工和回收的公司,部分归美国政府所有。该公司创始人布莱恩•梅内尔(Brian Menell)称这是“一项艰巨的任务”。“在10年的时间里,一个完全优化的已开发的锂离子回收电池行业可能会提供电动汽车行业25%的电池金属需求。”他表示,“因此,它将是一个贡献者,但不是一个解决方案。”

The real volume could be created when the industry recycles more electric vehicle batteries. But they last an average of 15 years, so the first wave of batteries will not reach their end of life and become available for recycling for some time. This extended timeline could be enough for technologies to develop, but it also creates risks. G2 Ventures’ Varman says recycling processes being developed now, for today’s batteries, risk being made redundant if chemistries evolve quickly.

当行业回收更多的电动汽车电池时,真正的产量就可以创造出来。但它们的平均寿命为15年,所以第一批电池不会达到它们的寿命结束,并在一段时间内可以回收利用。这一延长的时间线可能足以推动技术的发展,但它也会带来风险。G2 Ventures的Varman表示,如果化学成分发展迅速,目前正在开发的电池回收工艺可能会被淘汰。

Even getting consistent access to discarded car batteries could be a challenge, as older cars are often exported for reuse in developing countries, according to Hans Eric Melin, the founder of consultancy Circular Energy Storage.

咨询公司Circular Energy Storage的创始人汉斯•埃里克•梅林(Hans Eric Melin)表示,即便是持续使用废弃汽车电池也可能是一项挑战,因为老旧汽车经常出口到发展中国家进行再利用。

Melin found that nearly a fifth of the roughly 400,000 Nissan Leaf electric cars produced by the end of 2018 are now registered in Ukraine, Russia, Jordan, New Zealand and Sri Lanka — places where getting a hold of the batteries at end-of-life is harder.

梅林发现,2018年底生产的约40万辆日产聆风电动汽车中,有近五分之一是在乌克兰、俄罗斯、约旦、新西兰和斯里兰卡注册的,这些地方的电池寿命结束后更难获得。

Berdichevsky of Sila Nano says his aim is to make EV batteries that last 30 years. If that can be accomplished, pent-up demand for recycling will be less onerous and costs will fall, helping to make electric vehicles more affordable. “In the future we’ll replace the car, but not the battery; of that I’m very confident,” he says. “We haven’t even scratched the surface of the battery age, in terms of what we can do with longevity and recycling.”

Sila Nano的伯尔迪切夫斯基表示,他的目标是制造续航30年的电动汽车电池。如果这一目标能够实现,被压抑的回收需求将变得不那么繁重,成本也将下降,有助于让电动汽车变得更便宜。“在未来,我们会更换汽车,但不会更换电池;我对此非常有信心。就寿命和循环利用而言,我们甚至还没有触及电池时代的表面。”