American consumers have become used to buying T-shirts, plushies and other knick-knacks from the likes of Temu and Shein at rock-bottom prices. Whether they knew it or not, their bargains were partly the result of an old tax loophole that is now being taken away. Fortunately for them, the future of online binge-buying remains cheap, if a little less cheerful.

President Donald Trump’s crackdown on the “de minimis rule” — which allows overseas packages valued at $800 or less to enter the US tax-free as long as they are sent directly to individuals — means that a $10 mini skirt, dinner-plate set or inflatable hamburger outfit will now be subject to normal import taxes as well as the extra 10 per cent tariff that Trump has levied on all imports from China.

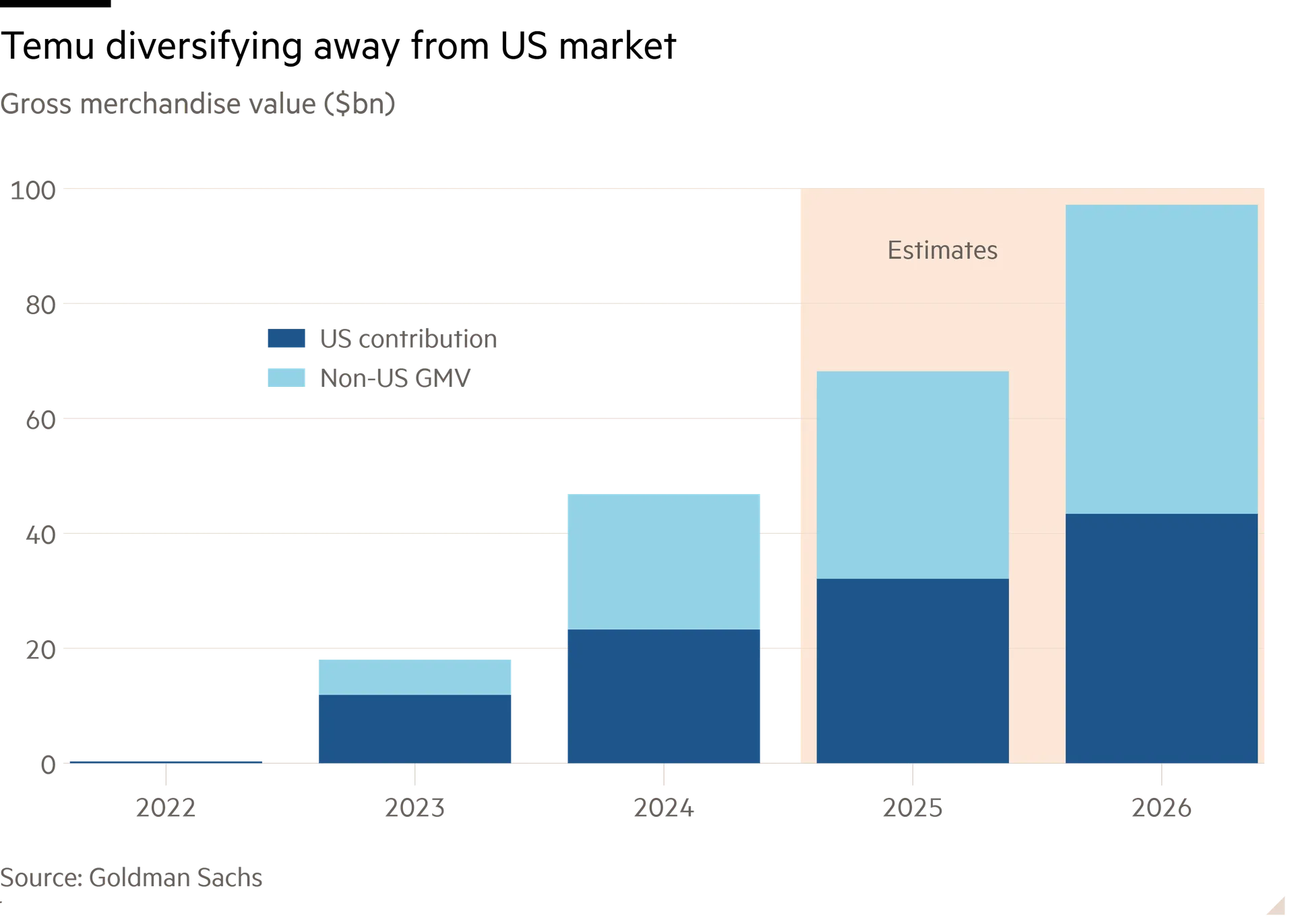

Temu, in particular, has been preparing for this day. The online store, part of Chinese internet group PDD, has been growing strongly. Bernstein Research reckons its global gross merchandise value — the total of all goods sold — jumped from $17bn in 2023 to more than $50bn last year. The figure could double to $97bn by 2026, according to Goldman Sachs.

It has also diversified geographically — limiting the impact of tax loophole closures. The US accounts for less than half of Temu’s global GMV, compared with 100 per cent three years ago, when the app first launched.

Meanwhile, Temu has moved away from its “direct from China factory floors” consignment business model. It has recruited vendors who already have goods in US and European warehouses and simply use Temu as a shop window. Goods sold under this semi-consignment model, in which vendors handle their own shipping and delivery logistics, were already imported in bulk, so didn’t benefit from the de-minimis perk. Temu competes with Amazon for their business, with lower and fewer fees.

This strategic shift leaves Temu less reliant on China-based merchants selling small lots of merchandise overseas. Indeed, semi consignment vendors now account for about a quarter of Temu’s US GMV, says Goldman. The adoption of this model in other countries means only 20 per cent of Temu’s global GMV is exposed to potential changes in the de minimis provision, added Bernstein.

Like Shein, which is unlisted but considering a London initial public offering, Temu doesn’t need a tax quirk to be a big threat to bricks-and-mortar retailers. Trump’s trade war is expected to drive prices for everything from avocados to energy higher — which means the “trading down” trend could get a new fillip. De minimis might describe these retailers’ prices, but the businesses themselves are anything but.